What’s Working Now in GTM AI: How Rally Reimagined Win Analysis with AI

A practical look at using AI to uncover why deals really close—and how to operationalize those learnings.

Every company wants deeper insight into why they win (and lose) deals. But actually getting that insight is a different story…and a consistent question we ask in the board room. Where are we winning and why? What can we learn that we can apply to the process or product? And can we leverage AI to get better insights faster?

I asked the CMO of Rally, Juliette Kopecky, to work on a project with me to test using AI to build this process in a way that is reliable, repeatable and actually useful. This process can also be used to understand why you lose deals, too, and ultimately combine those learnings to forecast more accurately.

Below is a recap - what wasn’t working, what Rally did with AI, and what they learned so you can implement this in your own organization.

The GTM Challenge: Win-Loss Is Critical… But Hard to Do Well

Win-loss analysis has always been a high-leverage GTM motion. It tells you why customers buy, where your product differentiates, and what is working in your process.

But despite its importance, the traditional process is riddled with problems:

1. The reasons behind wins and losses are complex.

No two deals are alike. Context, champions, competitors, timing, procurement, pricing—so many factors influence outcomes that it’s difficult for humans to abstract meaningful patterns at scale.

2. There is bias on both sides.

Buyers don’t always tell you the full truth and sellers have blind spots and emotional investment in the deal.

3. It is extremely time-consuming.

One-on-one interviews take hours to schedule, conduct, transcribe, and analyze. Most companies only do a handful per quarter—far too few to spot meaningful trends.

What Rally Tried: A Three-Phase AI-Augmented Win Analysis Workflow

To tackle the challenge, Rally broke the project into three phases—each building on the last.

Phase 1: Can AI replicate the win interview using sales calls alone?

Instead of relying on scheduled buyer interviews, Rally asked:

If we feed AI the sales call recordings, can it reconstruct what a proper win-loss interview might uncover?

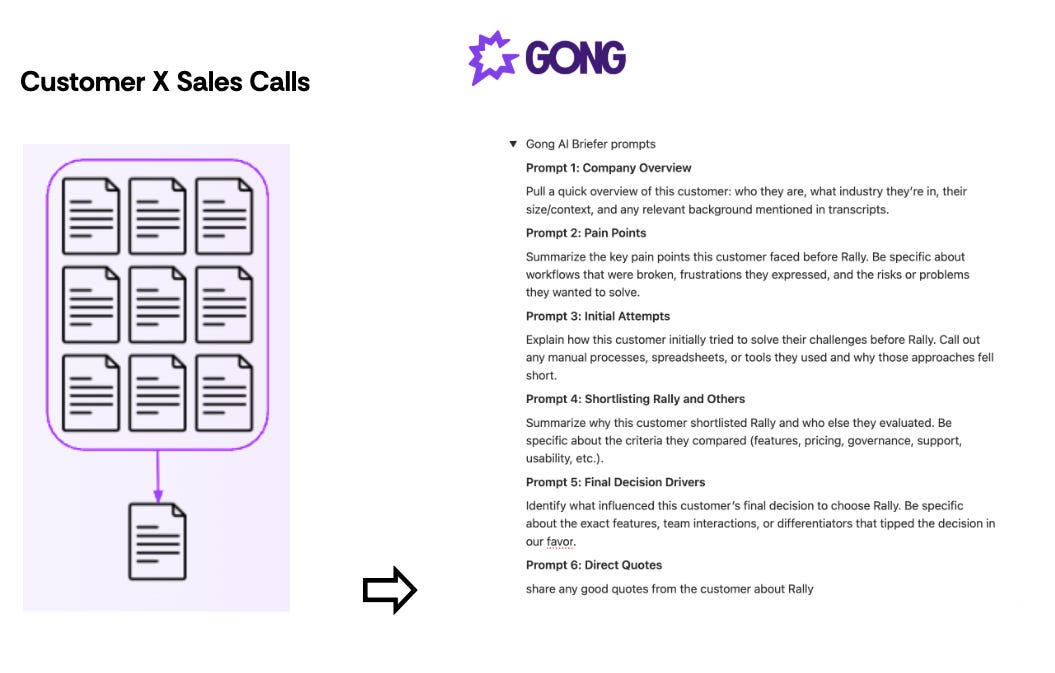

They processed large volumes of sales conversations from all their won deals in a quarter and evaluated whether AI could extract insights similar to human-led interviews. Rally uses Gong to record their calls, so they tested Gong’s built in AI analysis to summarize the calls. They uploaded their own list of prompts so that the summaries were consistent from call to call.

What they learned: AI is surprisingly strong at pulling structured information out of unstructured call data. It can summarize, classify, and surface themes quickly—producing a baseline “interview-like” assessment without ever speaking to the customer.

Phase 2: Can AI identify trends across deals?

Once AI could summarize individual sales calls, the next question was scale:

Could AI detect patterns across dozens or hundreds of deals?

This phase involved aggregating insights across call transcripts—things like:

What customer pain points resonated the most?

What product features did customers want?

How did the product compare to their current solution and/or competitor offerings?

What are key steps in the process for buyers? What roles need to be involved?

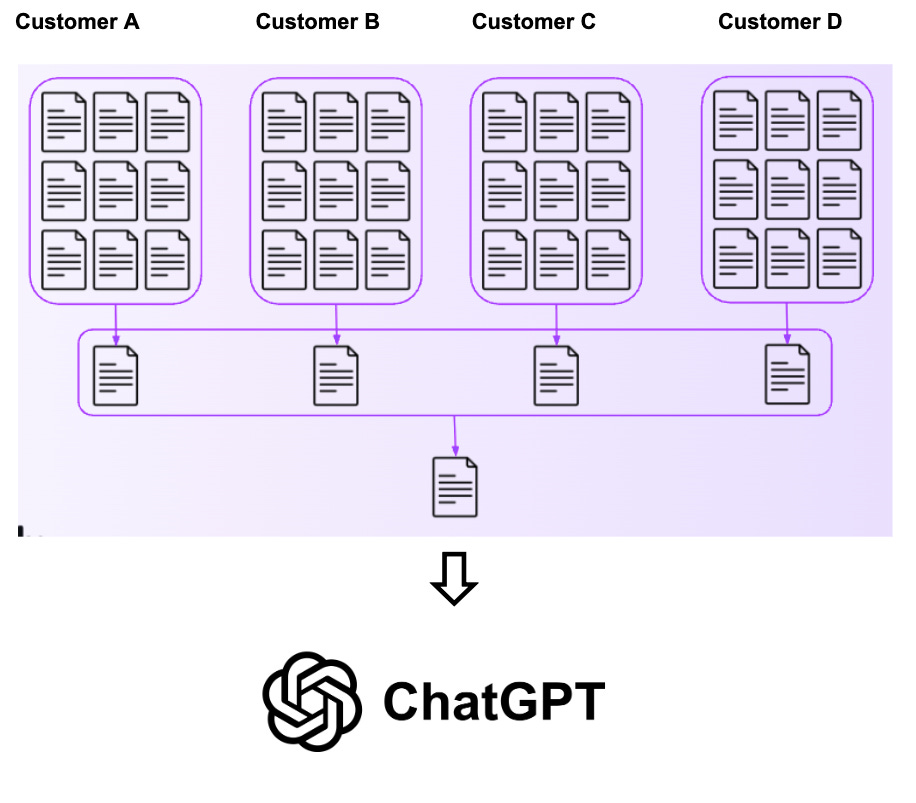

Rally uploaded these summaries to build their own GPT in ChatGPT so they could run the insight analysis across all of the call summaries. They did this manually, but realized they could also automate it in the future given that Gong has an API into ChatGPT.

What they learned:

This is where AI shined. The model could sift through massive volumes of interactions and surface repeatable patterns much faster than any manual process. Rally could take these learnings and apply them back to the sales process so that they could ensure that they were following all the right steps to have the best outcome. For example, the majority of the won deals were focused on doing research with their own users, improving governance and compliance in their research practice, and speeding up the research recruitment process, so they have prioritized these use cases in discovery.

Phase 3: Can AI predict outcomes and recommend actions?

The ultimate ambition:

If AI can understand the past, can it help shape the future?

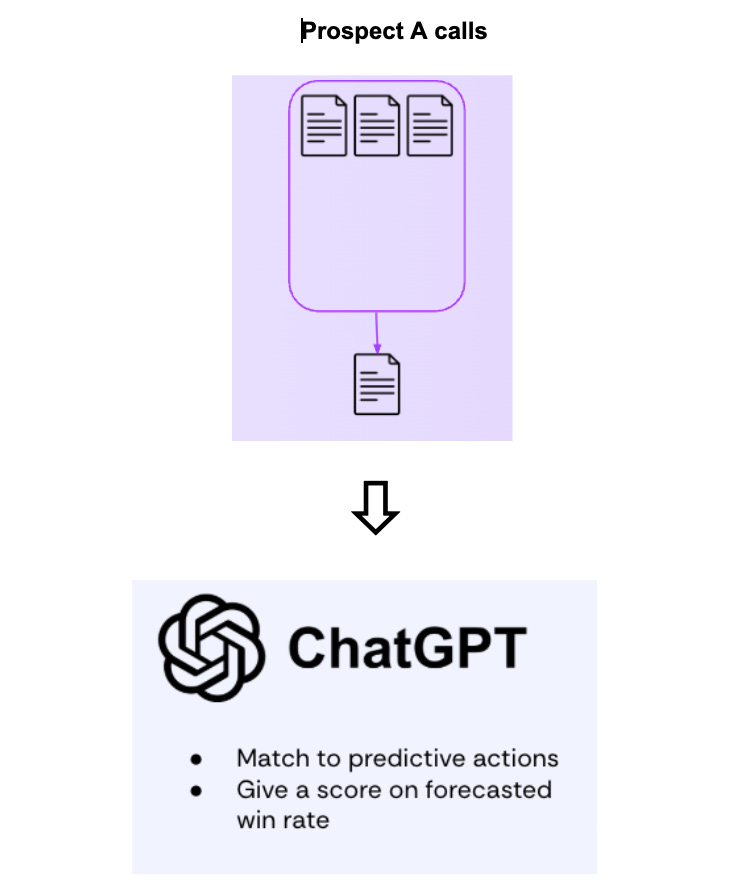

This phase can test whether AI could not only analyze trends but also predict deal risk, flag competitive steps, suggest next steps, and recommend product improvements. Rally is testing this phase now to see if they can run the first 2-3 calls once a deal reaches a certain stage to determine the likelihood of closing. To do this, you can build another custom GPT as a Forecast and load in the several attributes and prompts you want it to detect in the call. It can give you the results, as well as a forecast.

The Outcome: A Hybrid Approach Is the Winning Formula

After running all three phases, Rally reached a clear conclusion:

AI is incredible for helping us with:

Speed

Breadth

Pattern recognition

Synthesizing large amounts of data

But AI alone is not a replacement for human-led conversations.

The richness, nuance, and authenticity of a live customer interview still matter—especially for complex buying journeys.

So what’s the right approach?

AI as the starting place for analysis, humans for depth.

AI dramatically improves the win-loss process by:

giving teams the ability to analyze more data, more often

preparing interviewers with a stronger context

filling insight gaps when a buyer won’t take a call

generating trendlines that humans simply cannot see

This hybrid model creates better conversations, better enablement, and better GTM decision-making, all while saving teams enormous time.

What This Means for GTM Teams

Win-loss analysis used to be something companies did quarterly because of the time commitment. With AI, it can be continuous. And when paired with human depth and judgment, it becomes one of the most powerful GTM tools available. This project showed that the future of GTM isn’t AI or humans—it’s AI-powered humans making better, faster, more confident decisions.

My challenge to you: Run this analysis for both deals you won and deals you lost on your Q4 data. Include two slides in your Q1 Board Deck:

Why we win deals

What our CRM says

What AI says

What we learned

Why we lose deals

What our CRM says

What our AI says

What we learned

If you want to share, I would love to hear about it!