Three Metrics Every New Founder Should Track

Focus on value delivery, not vanity dashboards, in your first 12–18 months.

DEAR STAGE 2: We’re about to onboard our first paying customers. What metrics actually matter right now? — Getting Started

Landing your first paying customers is a big moment. It’s validating, energizing… and let’s be honest, a little overwhelming.

You’re not just building product anymore, you’re running a business. And for product-led teams, that shift raises a classic tension:

We know we should be tracking metrics, but we don’t have time to track everything, and we’re not sure what actually matters.

Here’s the good news: most early-stage companies try to track too much, too soon. The ones who scale well? They focus on a tiny handful of metrics that actually answer one question: Is the business working before revenue scales?

Let’s break that down.

The Early-Stage Trap

At Stage 2 Capital, we see early-stage teams fall into two common traps when it comes to metrics:

Tracking nothing, because “we’ll worry about metrics later.”

Tracking everything, filling dashboards with vanity numbers that feel productive but rarely change decisions.

Neither approach works.

Before you chase growth, before you optimize for efficiency, before you worry about CAC or LTV, you need to validate one thing: Are customers getting real, repeatable value from your product?

The Three Metrics That Matter

In your first 12–18 months, success = value delivery. That’s it.

So let’s keep it simple. Here’s what we recommend tracking:

1. Leading Indicator of Retention (LIR)

The best proxy for long-term value

You don’t have enough time (or customer volume) to wait for churn numbers. Instead, define a leading indicator. This is an observable behavior that signals a customer is likely to stick around.

Examples:

For Slack: teams sending 2,000+ messages

For a data tool: weekly active users pulling reports

For a workflow product: creating and reusing 3+ workflows in the first 30 days

Your LIR should be:

Measurable (yes/no per customer)

Tied to value (not just usage)

Predictive of retention (even if directionally at first)

Pro tip: Don’t wait for perfect. Pick a hypothesis, measure it, and refine.

2. Time-to-Value

How quickly are new customers seeing impact?

Once you know your LIR, track how long it takes new customers to get there. This is your time-to-value, and it’s an early pulse on product clarity, onboarding, and customer experience.

Early warning sign? If it takes too long for customers to get value (even if they eventually do), you’re already at risk of churn.

Shorten time-to-value before you scale. It pays dividends later.

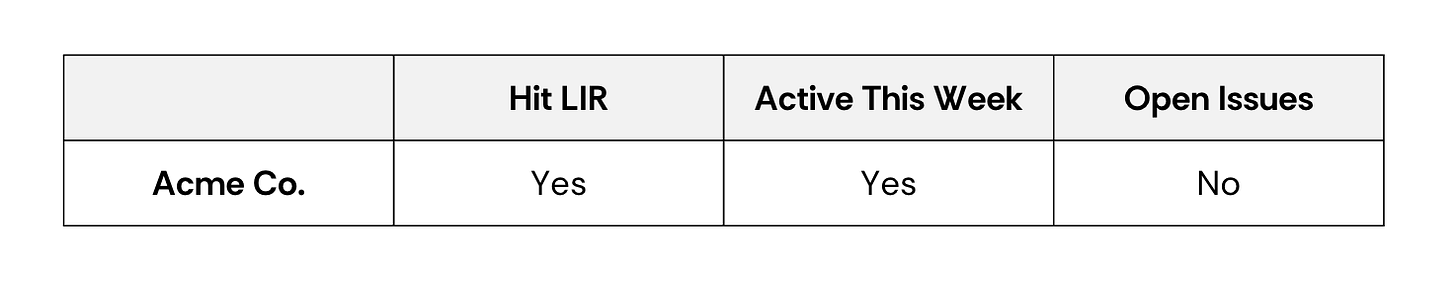

3. Customer Health Rollup

A simple weekly gut check (in a spreadsheet is fine)

You don’t need a full analytics stack. But you do need a way to consistently ask:

Who’s healthy?

Who’s stuck?

Who’s at risk?

This is less about reporting and more about confronting reality before problems compound.

What Not to Optimize (Yet)

Feeling pressure to track CAC, LTV, gross margin, burn multiple?

Ignore it. Seriously.

Those metrics matter a lot. But only later, after you’ve nailed value creation and retention first.

Optimizing too early = polishing a funnel that doesn’t work yet.

First: make it work. Then: make it efficient.

A Final Thought

Right now, your job isn’t managing a dashboard.

It’s learning faster than your problems grow.

That means choosing a few high-signal metrics, revisiting them often, and using them to drive smart decisions before growth masks the truth.

This approach is core to how we think at Stage 2 and baked into the Science of Scaling framework. Define value clearly. Measure it early. Then build on what works.

If you get this right, everything downstream gets easier.

Until next week!