Credits Aren’t a Strategy: Rethinking AI Pricing Models

Why today’s popular hybrid pricing is just a bridge to better value capture (and how to make it work for now)

DEAR STAGE 2: We’re in the early stages of monetizing our AI features. We’ve seen other companies’ hybrid models with credits and subscriptions take off, but we’re unsure how to structure ours. What should we watch out for? ~PRICING IN THE AGE OF AI

DEAR PRICING IN THE AGE OF AI: When it comes to monetizing AI, the stakes are high for both your revenue model and customer trust. No one has been deeper in the pricing trenches than Kyle Poyar, author of Growth Unhinged and longtime pricing strategist. Kyle joined us in NYC last week for our annual summit and shared some incredible insights on making the shift to value-based pricing.

He covered a lot of ground, but we’re going to go deep on this one question of hybrid pricing today. Hybrid pricing models (think “$X/month + Y credits”) have exploded recently, especially for products embedding AI. Companies like Clay, Intercom, and Salesforce are layering credit models into traditional SaaS plans to balance cost control with flexibility. They work because:

You can meter usage and protect your margins.

You can give customers a taste of AI functionality without forcing a full commitment.

You can scale spend with value delivered.

But Kyle cautioned that these models aren’t magic. If you’re just copying what others are doing, you’re probably not thinking deeply enough about how it aligns with your own product and customer base.

Read on for his advice!

1. Design for Expansion, Not Confusion

While customers are willing to manage credits and take on some risk for their top vendors, “no one wants to manage 20 different credit systems,” Kyle warned. Your model should feel intuitive. If customers can’t predict what their bill will be, or if credits are so abstract they can’t understand them, they are far more likely to churn.

What to do:

Use credit models to mirror your product’s natural usage pattern.

Clearly define what each credit gets the user (e.g., 1 credit = 1 document processed).

Offer visibility into usage in-app, in real time.

What not to do:

Don’t bury definitions in fine print.

Don’t mix too many pricing levers - it will feel chaotic and hard to control.

2. Avoid Flat Fees Unless You Have Sky-High Margins

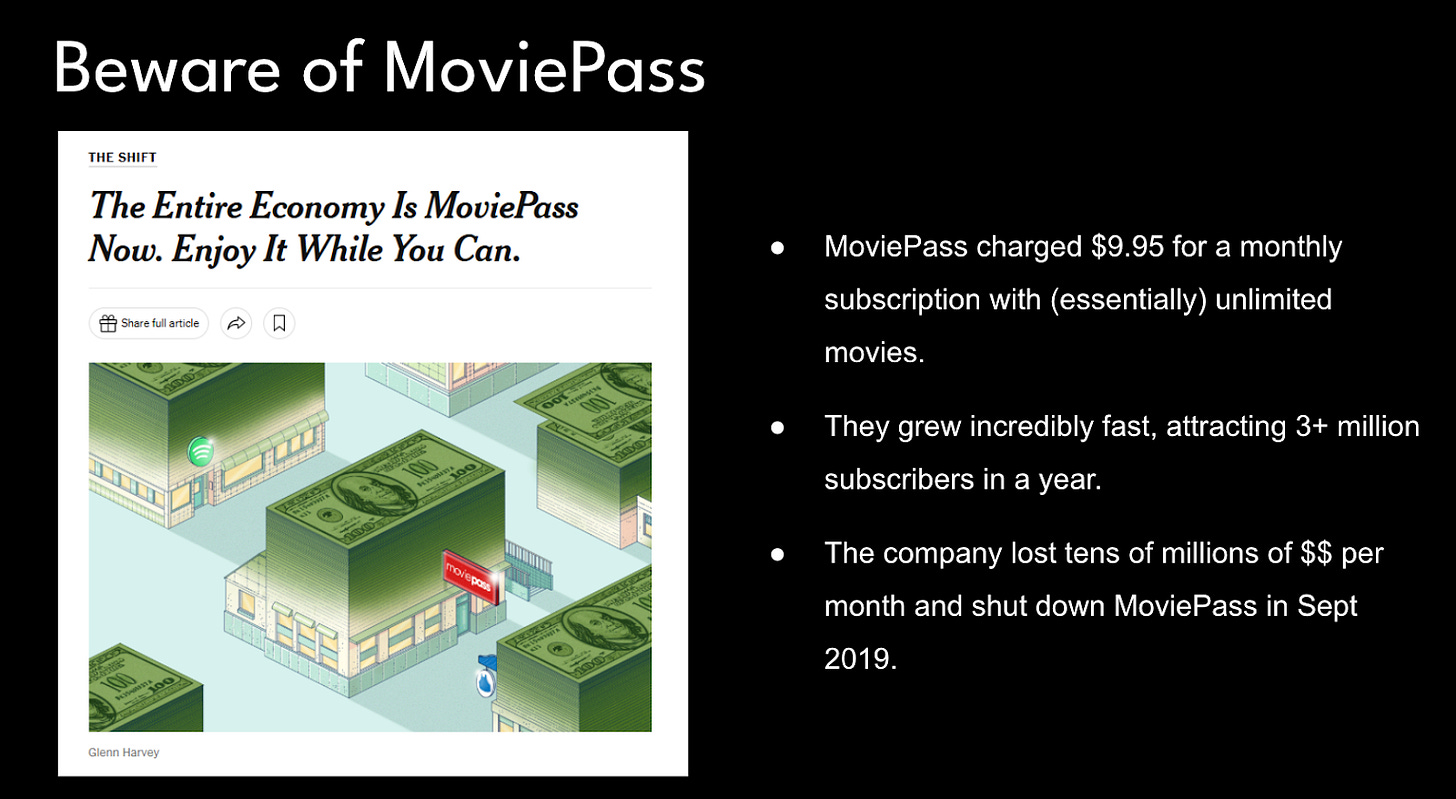

Flat-rate AI pricing? That’s a trap for most early-stage companies. Kyle compared it to MoviePass (an incredible non-SaaS example of pricing gone wrong - MoviePass went under with their initial flat rate offering losing tens of millions every month, but has now reemerged with higher prices and a credit-based model): great for customer adoption, but a death spiral if your power users start racking up heavy compute costs.

Instead:

Cap usage to protect yourself from power users (usage tiers with overage). In Kyle’s experience, the top 10% of users might account for 70-80% of your AI costs.

Use hybrid pricing to give customers predictable spend with room to grow.

Treat AI usage as a variable cost center to align pricing with margin reality.

Put in place discounting rules to minimize pricing leakage and unprofitable customers.

3. Credits Aren’t the End Game

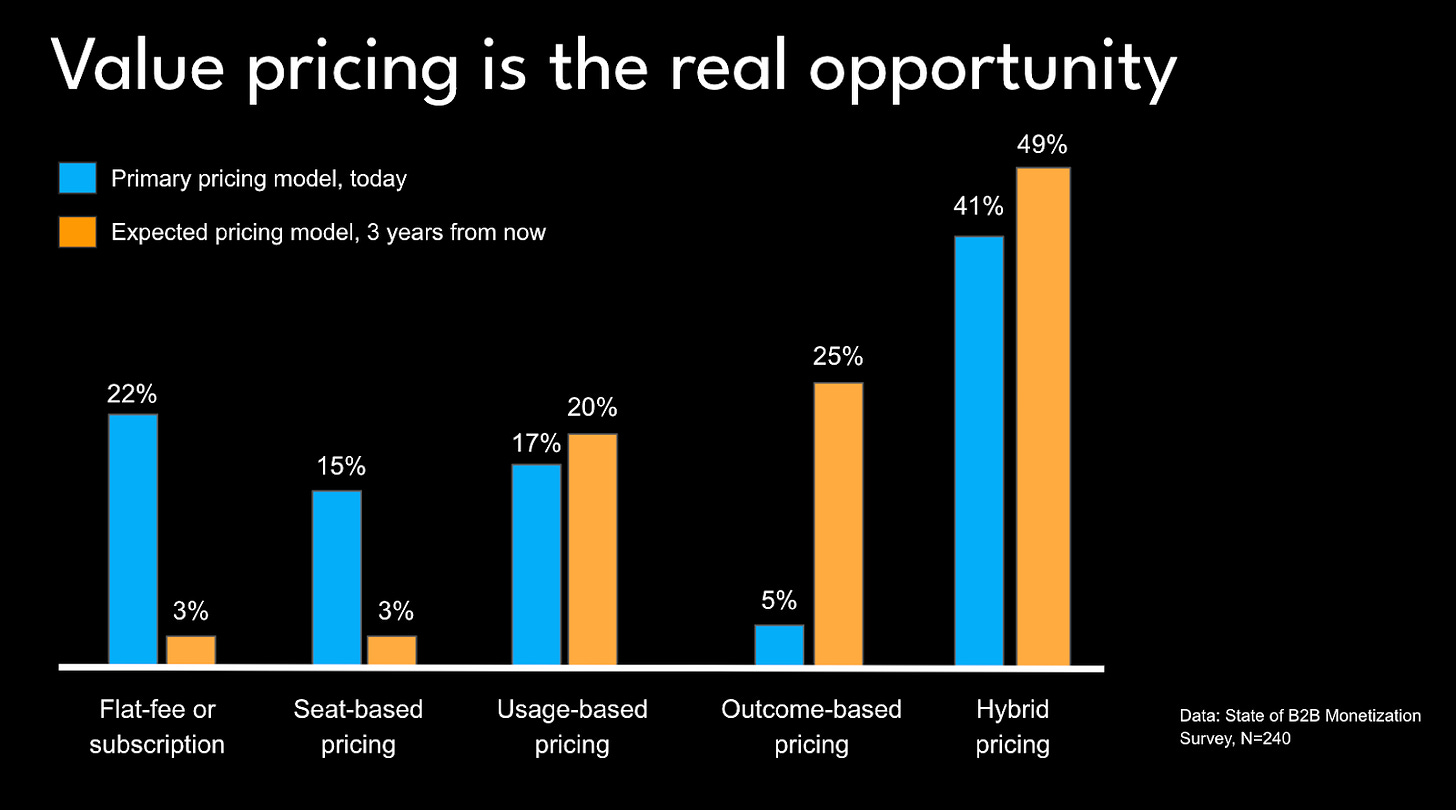

Hybrid pricing with credits are a stepping stone toward more value-based models. In Kyle’s words: “The real opportunity is value-based pricing. Credits are the bridge.” Today’s customers will tolerate credits, but as AI matures, they’ll want pricing that reflects outcomes or the work delivered by AI. That could mean tying pricing to support cases resolved, tasks automated, or chargeback revenue recovered. Until you get there:

Use credits to train your buyers on usage patterns.

Monitor which features deliver the most ROI.

Start gathering data you’ll need for future pricing changes.

4. Don’t Set It and Forget It: Build a Pricing Review Cadence

Most early-stage companies treat pricing like a one-time decision and you are leaving money on the table. Build the muscle early of reviewing, experimenting, and changing pricing as your product evolves. Kyle recommends:

Monthly pricing working sessions, especially at early stage.

Pricing post-mortems after any changes.

Giving someone (anyone is better than noone!) ownership of pricing metrics and strategy. And if you’re under $5M ARR, that someone is probably still you, the founder/CEO.

Insightful framework on AI pricing evolution. The move from flat fees to credit meters to value-based models reflects a broader shift in how B2B companies price risk, flexibility, and outcomes. TCLM digs into the financial operations side of those pricing transitions. Worth a look.

(It’s free)- https://tradecredit.substack.com/